Selling Puts On Unprofitable Businesses

Why I Stopped Selling Puts on ANF After Crushing It for a Long Time

I talk a lot about my "Legendary ANF Trade" - inside The Leveraged Investing Club, throughout the Great Option Trading Strategies website, and in the Daily Tips and Insights Newsletter.

The trade really underscored the huge structural advantages of the customized way we sell and manage put options inside The Club.

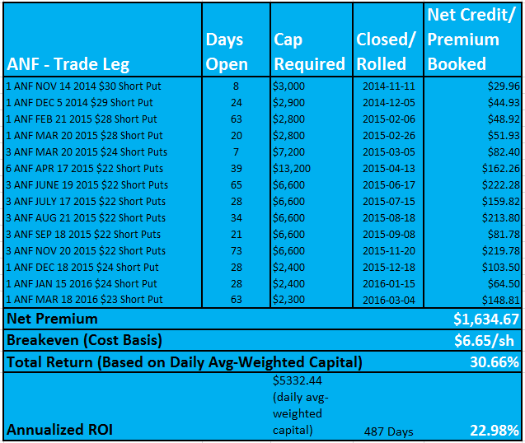

The final ROI numbers were very impressive, especially in light of how horrible the stock itself performed:

I banked 30.66% total returns over 487 days (or 22.98% annualized) even as the stock itself cratered 49.94% at its closing low vs. my original entry point.

(Click Table for Larger Image)

The stock eventually rebounded back to the low $30s at which point I walked away from the trade, but then when it sold off once again into the low $20s, I re-entered it and collected another 27.80% annualized ROI over 85 days.

And then I walked away again and haven't written another put on the stock since.

So Why Did I Stop Writing Puts On ANF?

The question arises - if I had been able to make such great returns selling puts on a stock, even as it cratered, why would I ever stop selling puts on it?

It's simple.

When I was selling puts on ANF, I was totally comfortable doing so in spite of the stock's horrible performance because I felt there was an ultimate safety net - the underlying business's continued profitability.

Mr. Market's abuse of the stock wasn't that ANF was losing money - it was that the company simply wasn't making as much money as it had in the past.

But at some point, that stopped being true.

In fact, in March of 2017, Abercrombie & Fitch reported its first annual loss since going public more than 20 years earlier (1996) and was subsequently slapped with a junk rating on its corporate debt.

How to Never Lose Money Selling Puts

In the put writing based Sleep at Night High Yield Option Income Course I demonstrate a powerful mathematical principle:

If you have unlimited capital, and as long as a stock doesn't trade down to zero, there's no reason to ever lose money selling puts.

Yes, I know few of us have "unlimited capital," but that's simply the mathematical jumping off point to illustrate a point about how forgiving and flexible short put trades can be - here's what that principle looks like when developed and applied in the real world.

But once ANF stopped being profitable, that safety net was shredded in my view that safety net is no longer there and I was no longer comfortable selling puts on the stock.

Granted, that March 2017 annual loss was small, and the projected earnings over the following two years were close to flat or zero, but keep in mind that earnings projections two years prior were far too optimistic.

And with the debt downgrade, ANF's negative spiral, I felt, was likely just going to continue.

Insuring Stocks, Insuring Businesses

If a business can no longer earn a profit, what is its actual value?

How much would you pay for a business that you knew would lose you money?

When we sell puts, we're insuring a stock, and by extension, the underlying business. Or as I made the case here, we're ultimately insuring against the possibility that the underlying business completely falls apart.

At the time of this writing, I felt that there is a real risk that ANF does completely fall apart.

Sorry, Ambercrombie & Fitch, we had some great times and my portfolio thanks you, but there are too many better - and safer - opportunities out there than to insure a business whose survival is no longer guaranteed.

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop