The Psychology of Secular Markets

Part 3 - Mastering the Psychology of the Stock Market Series

In Part 3 of our series on Stock Market Psychology, we're going to explore secular bull markets and secular bear markets.

But first, a quick recap of what we've covered so far . . .

Recap

>> In Part 1, we looked at the Myth of Efficient Market Hypothesis (EMH).

Efficient Market Hypothesis, or EMH, is the belief that the stock market is highly efficient and "bakes in" all known and relative information so that the share price of a stock, at any given time, is a true reflection of value.

But when you take a common sense and pragmatic approach, EMH doesn't stand up to much scrutiny.

The one year chart of just about every stock doesn't reflect efficiency and rationality - it reflects messy human psychology.

>> In Part 2, we looked at the Myth of Smart Money in the stock market.

So-called Smart Money - i.e. the professional class of institutional traders and money managers - have a lot of retail investors quaking in their boots.

But the reality is that Smart Money is actually terrible at investing.

That's largely because they have too much money to manage effectively and are just as susceptible to a herd mentality as the rest of us.

They don't have an investing advantage then but a marketing advantage - over their own clientele from whose assets they're legally allowed to siphon off a certain percentage each year.

In that way, Smart Money is brilliant.

The Myth of a Normal Stock Market

Imagine there are three versions of yourself in a room - your 15 year old self, your 45 year old self, and your 70 year old self.

They're all the same person - you! - but at the same time, what strangers they would be to each other.

Their interests, their insights, their perspectives would all be totally different from one another.

Which is the "real" you or the "right" you?

It's the same way with the stock market - it changes and grows and evolves over time so that there's never a single "normal" market.

When you hear someone talk about the historical average returns produced by the stock market, or what an average or normal P/E valuation is for the market, feel free to tune them out.

They simply don't understand markets, what makes them tick, or how they materially change over time.

So what does make them tick and how do they materially change over time?

Two words - human psychology.

And what's most fascinating, it's a psychology that's on a (very) long term circular loop.

Most people assume that bull markets and bear markets are the products of how well or how poorly the economy is doing. Or how much money businesses are making.

That's true to an extent, and yet . . .

We have these long, multi-year (sometimes multi-decade) periods where the stock market primarily moves higher year after year (secular bull markets) followed by other extended periods where the stock market moves lower or basically trades flat (secular bear markets).

And these alternating markets have been going on for as long as there's been a stock market.

So let's walk through the process . . .

A Secular Bull Market Begins

A secular bull market begins when the market rises from its own ashes.

Stocks are dirt cheap because no one wants to own them, because no one trusts them.

Too many heartbreaks, too many years of associating the stock market with watching their money being lit on fire.

There are magazine covers lamenting stocks, the market becomes the butt of many jokes, and still the losses keep piling up.

There are few buyers, only sellers.

But finally, at some point, there's a capitulation of despair and everyone who's going to sell is already out.

In other words, there's no longer anyone left to sell.

At that point, a dirt cheap stock market simply can't get any cheaper.

That's when a secular market begins.

No Trumpets

When a secular bull market begins, there's no fanfare or official pronouncement.

In fact, investors have been shell shocked for so long, most won't believe that the winds have changed.

Most will distrust the stock market for years.

(Sound familiar?)

But gradually - and we're talking years here - investor sentiment will slowly improve, from outright skepticism to guarded optimism to actual optimism to enthusiasm and eventually to euphoria.

The Seeds of its Own Destruction

As you can imagine, every secular bull market contains the seeds of its own destruction.

The same irrational psychological process that pushed stocks to dirt cheap valuations will eventually be unleashed in the other direction as stocks - at the end of a secular bull run - begin to be priced at nose bleed levels.

And the same damn thing happens . . .

When stocks have been bid up so high, when Mr. Market is everyone's buddy, when everyone who's going to buy stocks have begged, borrowed, or stolen all they can to buy more, when there's no longer anyone left to buy stocks . . .

That's when the party ends.

And then the process reverses itself as investor sentiment runs the gauntlet of increasingly negative emotions all the way from denial to despondency.

Inhale-Exhale

This is a psychological cycle that's been in place for as long as there's been a stock market and one that most investors aren't even aware of.

Why is that?

Because these cycles take sooo long to unfold that we can't see them with the naked eye.

For both a secular bull market and a secular bear markets to each run their full course literally takes multiple decades to unfold.

Case in point - the last three secular bull market tops occurred in 1929, 1966, and 2000.

The Math and Psychology of Secular Markets

So this is my new thing . . .

I've long said that the stock market was a mixture of math and psychology.

But the longer I deal with Mr. Market, the more I'm convinced that the actual math is the smaller component.

In fact, I now argue that the stock market is comprised of 75% psychology and only 25% math.

And this weird phenomenal reality of alternating secular bull and secular bear markets is a perfect example.

P/E Expansion and Contraction

The math behind secular bull markets and secular bear markets is rather simple - how much are investors willing to pay for each dollar per share of a company's earnings?

That's never a constant amount.

But it's the key to understanding the mathematical fuel behind secular bull markets and secular bear markets.

A secular bull market begins from a very low valuation base.

Sure, increasing corporate earnings play a role, but the bulk of your returns during a secular bull market comes from P/E expansion - or the fact that investors are willing to pay more and more for each dollar of corporate earnings.

And the opposite is true during a secular bear market - over time, investors are willing to pay less and less for each dollar of corporate earnings.

P/E contraction.

A company's earnings may continue to rise, but if investors are willing to pay less and less for those earnings, the stock price will stay flat, or even fall.

That's when you know you're in the heart of a secular bear market.

So again, the mathematical principles behind secular markets are pretty straightforward.

But It's the Psychology That's Complicated

I won't pretend to understand the weird mental acrobatic processes that we investors use en masse to justify our irrational investing choices.

Why does the crowd pile in at market tops (and the same is true in real estate and other markets) and panic sell at the bottom?

Why do we keep repeating these patterns over and over and over?

I don't know the answer to these questions, but I do recognize the power and accuracy of the secular bull/secular bear paradigm.

And I've got a couple of visuals to show you what I mean.

Cool Graphic and Table

Here are a couple of my favorite secular market visual resources:

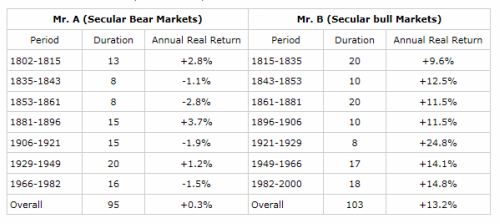

>> Secular Market Breakdown - This is a revealing table that author Michael Alexander put together that breaks down the annual real returns for secular bull and bear markets in the U.S. going back to 1802.

Not only does it illuminate this phenomenon of secular bull and bear markets, it really underscores an important facet of secular bear markets.

And that's the fact that over the entire secular bear period, the overall "average" returns are generally flat, and in some cases are actually positive.

Yes, there are some rough individual years in there.

But what's really going on is P/E contraction as the market zigs and zags (sometimes violently), but over the longer period, it's essentially a sideways market as earnings "catch up" to the previously elevated valuation levels.

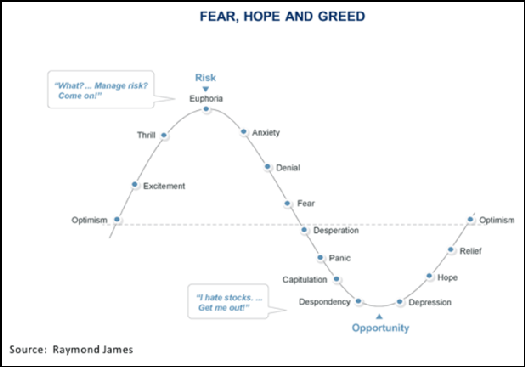

>> Fear, Hope, and Greed - I really love this graphic from Raymond James:

It nails the mass psychology of investors stage by stage throughout the complete, multi-decade cycle from despondency to euphoria and back again.

It's more than entertainment, of course - being able to accurately identify where we are in that cycle at any point in time is crucial to navigating a market that regularly confuses most investors and catches them flat footed.

So where are we today?

When I first wrote this article, I said that my best guess was that we were somewhere between Optimism and Excitement.

But something happened in the fall of 2019 when the market refused to go down for months on end.

And despite the covid crash in the spring of 2020 (or because of it, perhaps), we're in a very different psychological place, both in terms of society AND the stock market.

So my best guess now (as of February 2021) is that we're somewhere between Thrill and Euphoria.

If that's correct, then two things stand out for me:

>> Despite the euphoria end game now being nearer than where it was, these things can still take longer to play out than most realize - in other words, we may still have a while to go before the party implodes

>> But at some point, the party will end and it will be ugly - and it's our job to be ready for it rather than to go along with it (much tougher to pull off than you might suppose - although that's a conversation for another day)

Final Takeaway - The Inevitability of Bubbles

Related to that final point is an important insight:

Bubbles are inevitable.

We're never going to regulate or educate them out of existence because they stem from what's arguably the most powerful force of society - the psychology of human beings.

But just because others are doomed to repeat the same patterns over and over and over, that doesn't mean we have to be.

That rationale behind Ben Graham's concept of Mr. Market was so we could learn to exploit Mr. Market's irrationality rather than to be drawn into it.

And when our series here on Mastering the Psychology of the Stock Market concludes, we'll take a closer look at bubbles and explore how we might actually do that.

HOME : Stock Option Analysis and Articles : Psychology of Secular Markets (Part 3 - Mastering the Psychology of the Stock Market Series - Part 3)

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop