Repairing Short Puts

or

Heads You Win, Tails Mr. Market Loses

Repairing short puts is an incredibly important topic.

But in a weird way, I find that there's a danger sometimes in talking about trade repair.

That's because not everyone "gets" the profound implications of being able to fix losing trades and turn impending losses into eventual gains.

It's a radical concept - the idea that you can take losses off the table, that you can "renegotiate" yourself to positive returns no matter what, and that at the end of every trade, you're wealthier than when you started.

Case in point - check out the YTD performance of the Leveraged Investing Club's Insurance Company from Hell Portfolio where we've booked 34 profitable trades against just one small loss.

It sounds crazy and hype-filled, I know, but there's another reason why some investors and traders don't fully appreciate trade repair.

The Myth of Never Being Wrong

I trust you're not guilty of this or else you wouldn't be reading this article right now.

But there are a lot of naive traders out there who believe in what I call The Myth of Never Being Wrong.

It's not that they believe they're never wrong themselves.

But they believe there's some Holy Grail out there - some guru, some indicator, some secret - that at some level has the stock market completely figured out.

I use the analogy of Mr. Market a lot, a convention first created by Ben Graham, the Father of Value Investing.

Now, you have to remember who and what Mr. Market really is. He's the composite of everyone involved in the stock market - millions of investors from every retail and institutional walk of life.

Or, in other words, Mr. Market is the aggregate behavior of everyone in the stock market that isn't you.

To be sure, Mr. Market leaves plenty of clues about what's he more likely to do in the short term and what he's less likely to do when it comes to individual stocks in particular and the stock market in general.

But let's be very clear - there are no crystal balls that will tell you precisely what's going to happen and when.

There never have been crystal balls, and never will be.

But that's OK - what I've discovered is that I don't need a crystal ball to consistently record positive gains on virtually all of my trades - no matter what.

The Right Strategy

The right strategy for me - the one I use as the primary strategy in my 4th grader's account and in 90% of my own personal trades - is a customized put writing strategy I've developed and fine tuned over the last 15 years.

I love selling puts because, when approached intelligently and from a value investing mindset, the strategy can be both lucrative and extremely forgiving.

You certainly don't want to set up your trades arbitrarily or indiscriminately, but based on the customized selection and set up criteria and the trade management process I've developed, I have found that there are basically four outcomes when I write cash-secured puts.

And they all generate positive returns for me at the end of the day.

When I write or sell a put, I am, in effect, being paid to insure or offer to buy a certain stock at a certain price by a certain date.

Or, in other words, I'm betting Mr. Market that the underlying stock won't be trading below a certain level by the time the short put contract expires.

And then one of four things happens . . .

(Note: Click here for the complete trading history of the Warren Buffett Zero Cost Basis Portfolio)

#1 - I'm Right

I initially target 15-25% annualized returns when I set up my trades.

So when I'm right, and the underlying stock doesn't trade below the strike price at which I've written or sold my put, the put simply expires worthless at expiration and I book gains in line with the original terms of the trade.

Example: On August 25, 2014 with WAG (now WBA) trading @ $61.01, I wrote a $60 put on the stock that was set to expire on September 26th.

Fast forward - at expiration, the stock closed @ $60.18 and the put expired worthless.

Final profit was $79.96 after commissions on $6K worth of cash-secured capital over a 32 day holding period for a 15.20% annualized gain.

#2 - I'm Kind of Right

When I set up my trades I'm looking for what I call Limited Downside Situations.

I want situations where I can ideally identify multiple reasons why a stock is unlikely to trade lower, or lower by much, in the near term.

So sometimes, even if a stock is trading below the strike price on my short put position as expiration nears, it's not necessarily a bad thing.

Take the following series of trade on Coca-Cola (KO), for example.

>> On March 9, 2015, with KO trading at $41.60/share, I wrote an April 17 $41 put on the stock.

I collected $78.51 in net premium upfront.

>>On Thursday, April 16, 2015, one day prior to expiration, KO was trading @ $40.65.

At that point, I simply rolled the position from April out to May, buying back the expiring April put for $0.44/contract (or $44) and selling the May $41 put for $0.94/contract (or $94).

After commissions, I received a net credit of $43.98.

Because I roll the cost of closing out the expiring put into the proceeds of the new put, that allowed me to book the initial premium received (for selling the April put) as gains.

>>Fast forward to Wednesday, May 13, 2015, this time two days before expiration, and KO was trading @ $41.02.

Even though the position was slightly out of the money (i.e. the stock was trading above the strike price on the $41 short put), I chose to roll the position again for a new net credit of $55.96 (it cost me $0.18/contract to buy back the expiring put but I received $0.80/contract for selling the new June 19 2015 $41 put - and then I had to also deduct the cost of commissions, of course).

>>Fast forward again, this time to Wednesday, June 17, 2015. Once again, two days before expiration, but this time KO was trading down @ $40.25/share.

Fortunately, I was still able to roll the position for a net credit. I bought back the expiring June 19 2015 $41 put for $0.78/contract and collected $1.36/contract for selling or writing a new $41 put expiring on August 21 2015. After commissions, I posted a net credit of $51.96.

>>The stock eventually rebounded and by August 5, 2016, with more than 2 weeks remaining until expiration, KO was trading at $41.92/share, and I chose to exit the trade altogether.

I paid $0.14/contract to buy back the August $41 put. I deducted that, along with my commissions, from that previous net credit of $51.96 to record a final gain of $32.47 on that final leg of the trade.

That original $78.51 calculated on $4100 of cash-secured capital on the first leg of the trade over a 38 day holding period equates to an 18.39% annualized return.

And the net credit generated by rolling the position from April to May ($43.98) produced a respectable 14.50% annualized return on its own.

Likewise, the roll from May to June which resulted in a $55.96 net credit worked out to be a 14.23% annualized return.

Even the last leg of the trade, where I rolled from June to August and then bought back my short put to exit the trade ahead of expiration, produced a positive return of $32.47, or a 5.90% annualized return over 49 days.

All told, I generated an accumulated $210.92 in total net premium on the four legs of the trade for an overall 12.60% annualized return over 149 days.

And that's on a stock that was essentially trading less than 1% higher at the end of the trade than it had been 149 days earlier when I first entered the trade ($41.92/share vs. $41.60/share).

#3 - I'm Really Right

If I'm "really right" about the underlying stock not trading lower or lower by much in the near term, the stock will spike higher at some point.

These are terrific situations because I'm often able to exit the trade early and in the process lock in a majority of the trade's potential gains in a fraction of the original holding period and free up my capital for new opportunities way ahead of schedule.

And because I'm locking in a majority of the potential gains in an abbreviated holding period, my annualized ROIs skyrocket.

Check out the following charts that tell the story:

Like this 9 Day 46.03% annualized return on MET.

And sometimes, I'm able to exit a trade at an opportune time and then re-enter it and ring the register twice.

Like this KMI trade that generated separate 17.90% and 48.90% annualized returns.

Or this TOL trade that generated separate 37.98% and 33.60% annualized returns.

#4 - I'm Wrong

No matter how careful I am, no matter how many clues Mr. Market leaves behind, sometimes I'm wrong about what I believe the stock's near term behavior is likely to be.

And that's when my 4 Stage Short Put Trade Repair Formula comes in.

This is what I rely on to take the guesswork out of the trade repair process, put the "Sleep at Night" back into the Sleep at Night High Yield Option Income Strategy, and pretty much outsmart Mr. Market every time.

Inexperienced or unrealistic traders may want to gloss over the notion of bad trades, but your long term success (or lack thereof) is determined as much by how you deal with your "losing" trades as it is by your "winning" trades.

The trade history of the Zero Cost Basis Portfolio is an open book.

Just as there are no crystal balls, there are no silver bullets either.

Some repairs take less time and capital to repair, some more.

And some repairs result in better returns than others.

Those are trade offs I'm more than willing to accept.

Because at the end of the day, when all the dust has settled, even modest returns are better than a big fat loss.

It only took 50 days to repair a short put trade on MCD where the stock initially fell 5% on me, and it produced respectable 13.42% annualized gains.

In contrast, it took me 163 days to repair an EBAY trade that went against me and the overall annualized ROI was just 6.47%.

Still much better than a loss, of course.

Same thing with DVN in the fall of 2014 when the stock completely collapsed.

I originally wrote a $70 put on the stock when it was trading @ $69.46/share.

The trade had a great first day when the stock closed above $70.

But from then on, it just continued drifting lower and lower and lower.

Two days before expiration, the stock was down in the mid-$50s!

(And two months later, it would trade even lower.)

But I was still able to repair the trade and exit it both safely and profitably.

The overall annualized returns on the trade weren't exactly breathtaking, of course, but a POSITIVE 6.10% annualized return over 233 days on what could have been a catastrophic trade impresses me to no end.

And it also means that the rules most investors and traders play under simply don't apply to me.

(Think there might be a few energy investors out there who would love to trade places?)

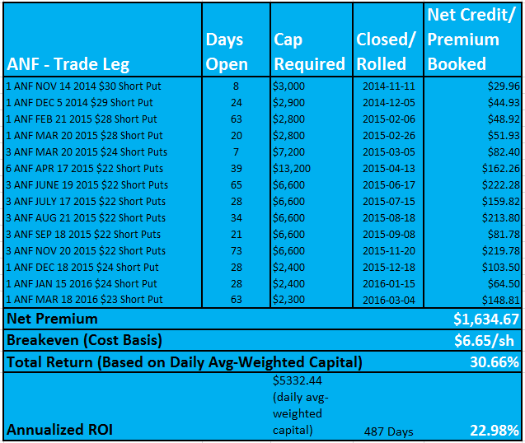

And then there's the ANF trade.

Long story, but this is a trade where I originally wrote a $30 put when the stock was trading at $32.86 on November 3, 2014.

The company had definitely been struggling and the stock was crushed.

During the summer of 2014, the stock was trading in the mid-$40s.

At the beginning of March 2015, and then again in late May 2015, the stock briefly traded below $20/share, but ANF wouldn't finally bottom until it sold off with the rest of the market in August 2015 and hit a closing low of $16.45/share, or a whopping 49.94% plunge from where I'd entered the trade.

Surely I had my head handed to me on this trade, right?

Far from it.

I officially repaired the trade after 226 days, and generated 17.78% annualized returns in the process.

Once it was repaired, I chose to keep the position open for as long as possible in order to really crank up the returns.

I was able to keep this one going for 487 days before the stock finally rebounded back near the levels where I'd first initiated the position.

The final results were outstanding - 30.66% total gains or 22.98% annualized on a stock that lost nearly half its value and took more than a year and a half just to get back to breakeven.

Or . . .

Heads You Win, Tails Mr. Market Loses.

Takeaway

I know this is a somewhat lengthy article, but it's an important one and here's the takeaway:

If I can consistently make money selling puts, even on stocks that crash . . .

If I've put together a full training course that details every aspect of my trade selection criteria, my trade set up methodology, and my customized trade repair formula . . .

If I demonstrate this entire trading approach with real world trades and in real time . . .

If I share my best trade idea each week . . .

If I demonstrate how I set up and manage these trades myself . . .

If I provide comprehensive analysis and commentary on these trades each week . . .

If I continue doing all this week after week after week after week . . .

And if I offer all this (and more) for a one- time price (with nothing to ever buy from me again or pay recurring fees for) . . .

Wouldn't you agree that this is a value and an opportunity you should take advantage of right away?

Tweet

Follow @LeveragedInvest

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop