How to Use Earnings to Manage and Repair a Short Put Trade

(Part 2 of 3)

Using the Earnings Calendar to Your Advantage Once You're Already in a Short Put Trade

When I moved to Montana in the early '90s (to go to school and to bum around, although not necessarily in that order), I put my small truck in the ditch twice during my first three winters.

I grew up in Oregon where there weren't that many opportunities to learn how to drive on snow and ice.

(When it comes to driving in rain and fog, however, I'm totally prepared.)

Sure, we would have occasional snow and freezing rain when I was growing up, but that was usually enough to shut down the town and keep everyone indoors.

"If you don't have to be out on the road, stay at home," is the common refrain you'd hear, not, "Road conditions are treacherous - perfect for practicing and improving your driving skills!"

But sometimes - at least this was the case for me as I was a bit of a wanderer in my 20s - it wasn't possible to avoid poor driving conditions.

In fact, I can remember all sorts of ugly winter driving conditions all up and down the Rockies during those years.

The Same Dynamics Are at Work When it Comes to Selling Options During Earnings Season

When the roads are iced over, when a company is about to report earnings, I keep my capital safely indoors and hold off setting up any new trades on that stock.

But once you're in a trade - once you're out on the road, as it were, and you need to get where you're going - you need to know how to handle the conditions and use them to your advantage.

So that's what we're going to cover here - how to use earnings to manage and repair a short put trade once you're already in that trade.

Why Avoid Earnings in the First Place When Selling Options

As I said in Part 1, there can be a case for trading earnings on a case by case basis, and that's fine as long as you're aware of the risks and you're OK with them.

For myself, I'm willing to leave the extra money on the table because I don't want to expose myself to the elevated risks of selling puts into earnings.

And the risks are elevated - as illustrated by the following chart on TEVA (and every earnings season, you can find many similar instances):

But What if You're Already in a Trade?

If you've been a reader of the Daily Options Tips and Insights Newsletter for any length of time, or if you've spent much time on the Great Option Trading Strategies website, then you know that I detest losing money to Mr. Market.

Ever.

In fact, that really is the chief objective of my customized, put selling based Sleep at Night High Yield Option Income Strategy - to never lose money in the stock market.

Part of that involves disciplined setups and not selling puts during earnings season without good cause.

And the other part involves having a robust, customized, and proven trade management and trade repair system in place.

I call it Heads We Win, Tails Mr. Market Loses.

When we're right selling puts and the stock trades flat to higher over the holding period, we make easy, lucrative, no drama returns.

Like this 37.42% annualized return over 34 days on DG:

Obviously, we try to do everything in our power to be right, but let's be honest - despite our best efforts and due diligence, it's next to impossible to consistently predict what millions of strangers in the stock market are going to do next.

So on those occasions when we're "wrong" and the stock trades lower on us, we turn our trades into campaigns and begin our highly customized and highly effective repair process.

Trades vs. Campaigns

Once we're in repair mode, we no longer have the luxury of avoiding earnings.

But that's OK for a couple of reasons:

- Something bad has most likely already happened to the trade to put things into repair mode in the first place - so at that point, we don't have a lot to lose

- We can also use the earnings calendar to our advantage once we're already in a short put trade

Let's take a closer look . . .

So here's how we approach things inside the Leveraged Investing Club.

#1 - When repairing an in the money short put position, we want any roll or adjustment we make to generate a net credit.

In other words, we want to collect more option premium setting up our new short put position than what it costs us to exit or close out the old one.

#2 - And ideally we also want to lower the strike price on our short put position whenever it's feasible to do so.

LOL - That's not much to ask for, is it?

>> But the more we're able to lower the strike price on our short put position, the less the stock has to "come back" in order for us to successfully exit the trade at some point.

>> And the more net credits we generate throughout the process, the more profitable we'll be when we do finally exit.

(When it comes to fulfilling this rather tall order, that's where the 4 Stage Short Put Trade Repair Formula comes in.)

So How Does Earnings Help Us Repair a Trade?

As we know, option premium levels are elevated for expiration cycles that include an anticipated earnings release.

And that's something we can work with as option sellers.

So when we roll FROM an expiration cycle without an earnings release TO a cycle that does include one, we get an automatic tailwind.

Admittedly, that tailwind can sometimes feel more like a gentle breeze than something that's really going to fill our sails.

That's because the deeper in the money a short put is (meaning the lower the stock trades compared to the strike price at which we've written our put), the less time value there's going to be on the new short put.

Even if that new short put's holding period includes a scheduled earnings release.

But this is the critical point - every little bit helps, and sometimes we get just enough extra juice to enable us to achieve our objectives.

In fact, I've seen it so many times now, I tend to take it for granted:

>> By rolling into an earnings-enhanced expiry, I either generate a bigger net credit on a straight roll (i.e. at the same strike price).

>> Or better yet, I'm able to work the strike price a little lower - and still generate a modest net credit - that I otherwise never would've been able to do had earnings NOT been involved.

And that new lower strike then makes all future rolls and adjustments on the trade that much easier to manage.

(Rolling down and out or even just straight out for net credits are basic repair techniques - the 4 Stage Short Put Trade Repair Formula includes those along with more advanced techniques and - just as critically - insights into the optimum timing on precisely when to use which technique.)

We Always Get Our Man

When we sell puts the Leveraged Investing Club way, and our trade goes against us, we're like the FBI or U.S. Marshal Service.

Mr. Market may be a fugitive from justice (as he tries to abscond with our capital), but we always get our man at the end of the day.

By always generating net credits on our rolls and adjustments, and by using basic to advanced techniques to systematically lower the strike price on our position over time, we're always lowering the breakeven or cost basis on our trade.

You have to realize - there's a limit to how low Mr. Market can drive the stock of a profitable business.

Although he can initially move a lot faster than we can, in contrast, there's NO LIMIT to how low we can drive the breakeven or cost basis on our trades.

So we eventually catch up to him.

And sometimes, when he can't take a stock any lower and he's tired of running, he'll turn himself in.

In fact, that's exactly what happened with the long running KORS short put trade below.

Check out the chart below - it's the complete opposite of what happened to TEVA:

The KORS earnings release in this case was well received, to say the least.

Pretty impressive - the stock closed the day 21.54% higher.

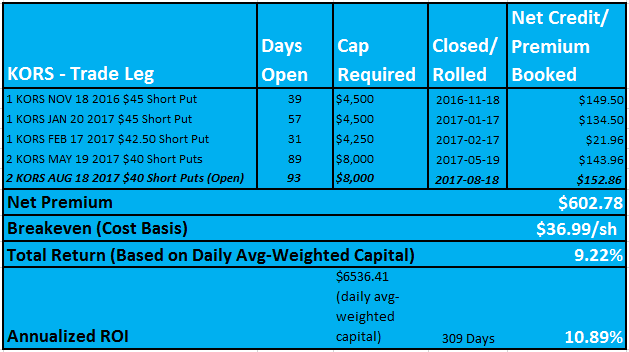

So here's the crazy thing - the trade originally began as a single November 2016 $45 short put on KORS.

As you can see, the stock traded into the low $30s over the summer before climbing some into earnings and then rocketing higher when the quarterly earnings report was released.

I stayed with the trade throughout, continually improved the trade and systematically worked it down to (2) short puts at the $40 strike expiring later in August.

And this is key - I also collected $602.78 of accumulated net premium since initiating the trade.

On an average daily-weighted cash-secured capital base of $6536.41, that works out to be 9.22% total returns (or 10.89% on an annualized basis).

Here's the KORS Trade Performance and History Table:

You know what I call that?

A Freakin' Success!

This is today's takeaway, and it's an important one.

We should do everything in our power trying to get into those DG type trades with the 37.42% annualized returns.

But unless we also have the capacity to take the KORS type trades and turn them around so that we still manage to walk away with 10.89% annualized returns, we're going to be in real trouble.

Because if we can't do that, the only way we'll ever come out ahead is if we're never wrong.

I don't know about you, but my perfection track record isn't all that impressive.

NEXT - An Important Tip About Option Trading and the a Company's Earnings Calendar

Finally, in Part 3 of this series, we'll look at why it's important to verify an earnings release date directly on a company's website instead of assuming your online broker or other financial website has the correct date.

Tweet

Follow @LeveragedInvest

HOME : Naked Puts : How to Use Earnings to Manage and Repair a Short Put Trade

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop