Reinvesting Dividends

Reinvesting dividends is a tremendous method whereby the long term investor achieves both compound growth as well as increasing cash flows.

It's a very straightforward concept - the idea is that you simply use the proceeds of each dividend payout to purchase additional shares of the stock. Even if the company never raises its quarterly dividend payout, the income you receive will increase every payout cycle because, with each cycle, you'll own more shares.

In the beginning, or with a modest portfolio, that may not seem like much. Perhaps that increasing cash flow may equate to only a few cents difference at first, but over time, as your portfolio increases in size, as with all long term compounding, the results of reinvesting dividends become more and more impressive.

The Power of Reinvesting Dividends

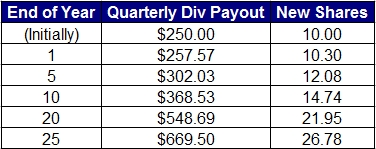

To illustrate the power of dividend reinvesting, let's look at a very simple example. Let's assume an investor purchases 1000 shares of a $25/share stock with an annual dividend payout of 4%, or $1 annual payout per share, or $0.25/share per quarter.

That equates to a $25,000 initial investment which would then produce $250 in dividend income each quarter.

Now let's make some other assumptions just to keep this example simple and easy:

- Dividends are reinvested

- Dividend remains constant (no increases or cuts)

- Share price always remains at $25/share

Now let's look what happens over time. You'll notice that in the beginning, the results aren't terribly impressive, but as time goes by, the power of compounding returns (in this case compounding cash flows) begins to assert itself.

Notes:

It's important to note that all we're really doing here is compounding the quarterly dividend payments at a 4% annual rate. That's really not very much, but it's still enough that you can see for yourself how powerful compounding is.

This may not be a particularly realistic example - in a lot of ways, the example seems more like reinvesting dividends on a preferred stock (a quasi-debt instrument) where the payouts are constant and the share price fluctuates very little - but the purpose of the example is to isolate and highlight the factor dividend reinvesting plays.

When you combine reinvestment along with dividend growth and the allocation of new investment funds, however, that's when you see results that are more dramatic (and attainable in the real world).

Finally, consider one other aspect of the power of compounded reinvested dividends. In the example above we used our 4% annualized payout to purchase more shares which, in turn, generated additional dividend revenue.

In our table, at the end of Year 25, the quarterly payout of $669.50 represents a 4% annual yield on the value of our current holdings. But when you calculate the payout in terms of your initial investment of $25,000, you're really looking at a 10.71% annualized dividend rate on your original investment solely from reinvesting those dividends.

The Dividend Reinvestment Program

I've written a full article about Dividend Reinvestment Plans as a no-frills alternative to Leveraged Investing.

Here's the abbreviated version:

Dividend Reinvestment Plans (DRIPs) are official, company sponsored programs that a number of dividend paying companies offer their retail shareholders. You essentially purchase at least one share directly through the company (i.e. direct purchase stocks) as opposed to going through a broker. The DRIP is administered by a third party organization who handles the messy accounting details involving partial share purchases, etc. Bottom line: There are no fees or commissions involved in any of this, even including initial or subsequent direct share purchases.

Additionally, most online brokers now offer their own versions of the dividend reinvestment program. You still pay a commission on any shares of the stock you directly purchase, but all reinvested dividends (if you elect this automatic feature) are done commission free. Many brokers also allow for partial share purchases through their reinvestment process.

Finally, you always have the option of designing your own customized dividend reinvesting program.

Dividend Reinvestment Drawbacks?

The primary drawback to all this dividend reinvesting is if/when the dividend paying companies you're investing in go bankrupt or experience some other significant deterioration in their business.

What a horrible thought - to spend 30 years reinvesting dividends in a company, watching that payout increase quarter after quarter, only to watch it all implode at the end. And take a big part of your income stream with it.

I'm not a big believer in diversification for sake of diversification. I believe all you really need is to focus on high quality, durable businesses with the strongest balance sheets you can find, buy shares at a good price, and you'll be just fine.

But there is some very real danger if you get seduced by low to mid quality companies just because they're also high yield dividend stocks. Look at that juicy dividend yield, you tell yourself with no small amount of lust. I'd sure like to reinvest that!

Be careful - it's probably not a good idea.

Dividends - Reinvesting vs. Spending

I have mixed feelings about reinvesting dividends. Yes, there is an impressive compounding effect to reinvesting, and there is also a natural dollar cost averaging benefit as well.

Dollar cost averaging is the practice of investing similar amounts of money equally over an extended time period. That means more shares will be purchased when the stock in question is trading lower and fewer shares will be purchased when the stock is trading higher. The theory is that dollar cost averaging helps lower the overall cost basis of a position.

And a particularly shrewd use of reinvesting is to use it in your tax-free retirement accounts. After decades of tax free dividend reinvestment, where the annual dividend payouts increase year after year, you could find yourself in retirement with a powerful personal income stream already waiting for you.

But still, I find myself drawn to the idea of spending rather than reinvesting dividends. Or at least of having the option of spending them if I want to. After all, what good is an income stream if you never get to use it?

Or looked at another way, if you spent your whole life reinvesting your dividends, then arguably you never really needed to invest in the first place.

OK - I admit that this may not be the very best investing advice you're going to find on the Great Option Trading Strategies website. After all, every situation is different. And the more you're able to delay gratification (or delay needing to spend your dividends on living expenses) and the more you reinvest your dividends in some manner, the more quickly those dividends will grow. But I just don't want to delay gratification so long that I never get to enjoy my dividends.

My Dividend Reinvesting Formula: Dividends + Dividend Growth + Leveraged Investing = Massive Passive Income

As previously mentioned, the example above, of compounding the dividend income by 4% a year, was designed to illustrate the benefits of reinvesting by isolating the effects (the example assumed no dividend growth or additional investments).

However, when coupled with dividend growth, the compounding effect becomes much more powerful.

Reinvesting dividends has the effect of compounding future dividends at the current dividend rate. Dividend growth has the effect of compounding future dividends at the dividend growth rate which, depending on the company, can be substantially higher than the current yield.

And then there's the Leveraged Investing option strategies I employ to enhance or accelerate this long term conservative investing style. Leveraged Investing is about two things - acquiring quality assets at significant discounts and then squeezing more out of them once you've acquired them.

When combined - reinvested dividends, growing dividends, and Leveraged Investing - you have a potent formula for putting together a powerful income stream in an accelerated time period.

I simply know no better or more effective way to invest.

Related Articles and Resources:

Create Your Own Dividend Reinvestment Program

Dividend Reinvestment Plans: A Leveraged Investing Alternative

High Dividend Stocks and Option Trading

Dividend Growth Investing: Why It's Superior To Growth Investing

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop