Managing the LEAPS Perpetual Income Strategy

In another article, I explained how we construct the LEAPS Perpetual Income Strategy so that, on an intrinsic value basis, our offsetting long call and long put LEAPS are guaranteed to never lose value.

And if you missed it, be sure to check out the introduction or overview of the Strategy here.

All that brings up the next important question:

So if the long portion of the trade can't gain or lose intrinsic value, how the $^%#$! do we make money here?

Simple.

We sell:

>> Near dated calls against the long call LEAPS for income

and . . .

>> Near dated puts against the long put LEAPS for income

Remember, LEAPS based calendar spreads have a huge leverage advantage. They're like covered calls on steroids.

For example, in this small KO calendar spread, there's roughly a 7:1 leverage ratio.

For the same capital amount required to purchase 100 shares of KO, I could control 700 shares of the stock (via 7 long call LEAPS the $35 strike).

In other words, we remove capital gains and losses from the equation and totally focus on generating a lot of income over the life of the LEAPS.

Brilliant, right? So why isn't everyone doing this?

Because there's a perceived drawback here . . .

While it's true that with our offsetting long LEAPS, the underlying share price has no impact on intrinsic value, that's certainly not true when it comes to all those near dated options we're selling for income.

The underlying share price has a huge impact there.

For example, let's assume once again the underlying stock is trading right at $40/share and we sell both $40 calls and $40 puts against the LEAPS.

Hot Dog! We're going to collect a lot of cash doing that.

And, by definition, because the stock can't close both above and below $40 when our short options expire, we know that either our $40 short calls or our $40 short puts are guaranteed to expire worthless.

But that's not the problem . . .

The problem is that the other set of short options that don't end up expiring worthless are going to end up in trouble.

Let's say the stock drops to $38/share. The $40 short calls will expire worthless (woo-hoo!), but all our $40 short puts are now $2/contract in the money (i.e. underwater).

So won't the losses on the short options that get in trouble exceed the gains from the short options that expire worthless?

Or, at best, won't we more or less just break even?

And while we try to pick strike prices on our long LEAPS that are deep enough in the money so that they contain as little time value as possible, we're still going to need to generate a certain amount of net income from our short options over the life of the entire trade to recoup those additional set up costs.

Wait a minute - this is starting to sound like a horrible strategy!

What We in the Club Know That Very Few People Outside The Club Know

With our Sleep at Night put selling strategy, if a trade goes against us, we don't abandon it.

We never leave our wounded behind on the battlefield.

We rescue and repair those short puts that trade in the money on us - even when they trade deep in the money.

(Check out Heads We Win, Tails Mr. Market Loses to see exactly why it's so rare that we ever book a loss at the end of our campaigns.)

If we can use our 4 Stage Short Put Trade Repair Formula to effectively repair just about any put selling trade that blows up on us, you better believe we can use these same tricks, techniques, and principles to the short put - and short call - components that act up on us here.

Conventional wisdom is almost always wrong.

One of the secrets to my success?

A combination of skepticism and stubbornness.

Instead of blindly following the trading adage to "cut your losers short," when it came to my in the money short puts, I held on for dear life.

I learned everything possible about bad put selling trades - including how to repair even the hairiest of them.

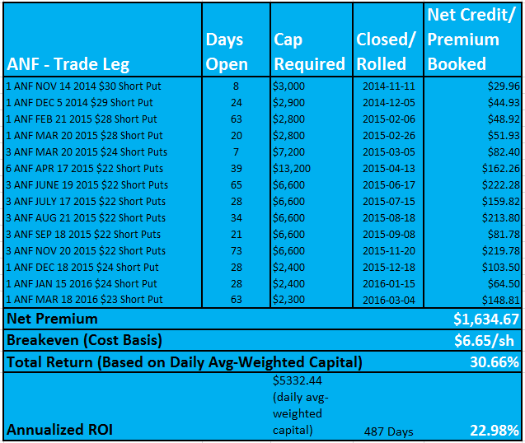

Like my legendary 487 day trade on ANF where the stock fell - at its closing low point - a horrifying 49.94% from my original entry point . . . and yet I still walked away with 30.66% overall POSITIVE returns (or 22.98% annualized):

I'm not bragging here, and I much prefer no-drama, easy return trades, but when it comes to repairing in the money cash-secured put trades, I've been doing this for so long now that I view my "bad" trades less as bad trades in need of repair and more in terms of more actively managed trades that just produce smaller gains.

In other words, I see them as no big deal.

It's like being a beekeeper.

To most non-beekeepers, the prospects of keeping bees seems crazy and dangerous.

But is it, really?

Case in point - how many beekeepers do we lose each year to the pursuit of honey?

In the same way, willingly choosing a strategy that regularly produces little problems to deal with may seem crazy at first glance.

But if those little problems are actually fairly easy to resolve, and you can make a lot of money in the process, that's not crazy, that's smart.

What's crazy is choosing strategies where you HAVE to successfully predict (guess?) the future or else you lose money.

Remember what we're shooting for here.

The objective here was to engineer an option trading strategy so that:

>> It doesn't matter where the underlying stock trades, whether we're in a bear market or bull market, and we never have to worry about trying to predict the future

>> The trade requires very little maintenance, incurs very little risk, and still spins off lots of income (real income, not just cash premium at the expense of capital losses somewhere else)

>> The strategy is simple enough to understand but still contains enough moving parts that it's guaranteed to keep lazy investors and traders from every really appreciating it

Now let's look at a very cool way to measure these trades - not only will it be eye-opening in terms of understanding the trade, but it will also give you a precise way to measure exactly how profitable the trade really is.

HOME : LEAPS Option Strategies : Managing the LEAPS Perpetual Income Strategy

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop