LEAPS Perpetual Income Strategy Examples

Two Documented Trades On PYPL

In this series on the LEAPS Perpetual Income Strategy, we've looked at the overview of the Strategy along with how to construct it, how to manage it, and how to measure it.

Now let's take this thing out of the harbor and see what it can do in the open waters.

In this article, we'll look at two documented trades using the LEAPS Perpetual Income Strategy - both of them on PYPL (payment processor PayPal).

But first . . .

Strategy Recap + Profitability Spread Review

To review . . .

>> The Strategy is constructed by buying deep in the money long call LEAPS and deep in the money long put LEAPS

>> We strive to buy LEAPS contracts with minimal extrinsic or time value (because we'll need to recoup that over the life of the trade)

>> The vast majority of the long LEAPS' value will be comprised of intrinsic value then - and because our long dated long calls and long puts essentially offset one another (whatever intrinsic value one set loses, the other set will gain), no matter where the stock trades, the position's overall or total intrinsic value will never decrease

>> With a constant intrinsic value on the long side of our trade functioning as a safety net, we're free to generate high yield income by strategically selling near dated calls and puts against the long LEAPS (i.e. calendar or time spreads)

>> The LEAPS Perpetual Income Strategy exploits the "covered calls on steroids" leverage advantage of calendar spreads in that we can control a lot more shares through our purchase of LEAPS options compared to purchasing (or shorting in the case of the long put LEAPS) the shares outright, and in the process, we can sell a ton more near dated options for income

>> We measure the trade's success by employing what I call its "Profitability Spread" - the more the annualized returns we generate from selling near dated options exceeds the pro-rated annualized cost or expense of the long LEAPS extrinsic or time value, the greater the trade's overall profits will be

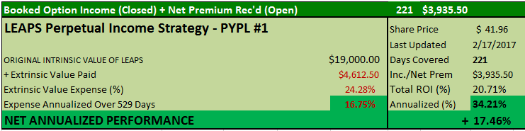

PYPL #1 (Stock @ $37.80 at time of setup)

>> LAST UPDATED - 2017-02-22

>> Initiated Trade on 2016-08-08

>> Purchased (10) JAN 19 2018 $28 LONG CALLS

>> Purchased (10) JAN 19 2018 $47 LONG PUTS

>> Total Cost = $23,612.50

>> Total Intrinsic Value = $19,000

>> Total Time/Extrinsic Value = $4,612.50

>> Total Extrinsic Value Expense = 24.28%

>> Annualized Expense Rate = 16.75% over 529 days until expiration of LEAPS

(Click on the image above to enlarge)

In summary -

>> My Extrinsic Value Expense = 16.75% annualized

>> The net premium generated and accumulated to date from selling near dated options against the LEAPS is currently 34.21% annualized

>> That means PYPL Trade #1 is, at the time of this writing, generating a positive 17.46% annualized profitability spread

Keep in mind that this first trade was about understanding the trade at a deeper level, not setting records, although these are still very solid returns for what's been an extremely low maintenance trade.

So let's move on to the next trade . . .

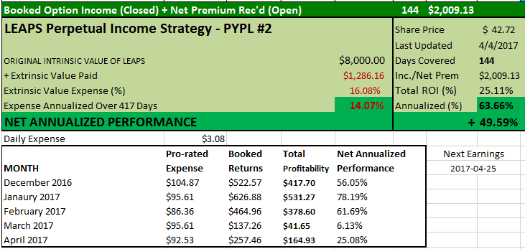

PYPL #2 (Stock @ $40.13 at time of setup)

>> LAST UPDATED - 2017-04-04

>> Initiated Trade on 2016-11-28

>> Purchased (4) JAN 19 2018 $30 LONG CALLS

>> Purchased (4) JAN 19 2018 $50 LONG PUTS

>> Total Cost = $9,286.16

>> Total Intrinsic Value = $8,000

>> Total Time/Extrinsic Value = $1,286.16

>> Total Extrinsic Value Expense = 16.08%

>> Annualized Rate = 14.07% over 417 days until expiration of LEAPS

(Click on the image above to enlarge)

So once again . . .

>> My Extrinsic Value Expense here is 14.07% annualized

>> The net premium generated and accumulated to date from selling near dated options against the LEAPS is currently 63.66% annualized

>> That means PYPL Trade #2 is - at the time of this writing - currently generating a positive 49.59% annualized profitability spread

Important Takeaways

We've definitely covered a LOT of material here, but before wrapping this up, I want to address the returns.

As you can tell, there's a big difference in the returns produced by these two trades.

In fact, in the early going of PYPL Trade #2, the spread between the two trades was even greater - +65.08% annualized net gains on PYPL #2 and just 9.84% annualized on PYPL #1.

At the time, both results seemed unrealistic - those 9.84% annualized returns on PYPL #1 were very low in my view.

And the +65.08% annualized profitability rate on PYPL #2 was also likely unsustainable, I felt at the time (primarily because while off to a great start, the trade had been open for just a short period at the time).

Now I'm not so sure about what the realistic upper limits of the Strategy is.

PYPL #2 is still generating nearly 50% annualized nearly five months into the trade despite a below averaged implied volatility environment over the last several weeks. Also, my next roll/adjustment will be into an earnings release which should bring in more net premium. We'll see how the trade performs in its final 273 days, but I'm obviously thrilled with the results to date.

The bigger picture is what's important, however - and by that, I mean the incredible structural advantages built into this thing and what I see as simple, low maintenance, low risk, high yield returns.

(It really is low maintenance - believe me, I spend a lot more time writing about the LEAPS Perpetual Income Strategy than I do actually trading and managing it.)

Whatever the final returns end up being for either of these PYPL trades, I'm confident that they're going to be a hell of a lot better than 9.84% a year.

The following section comes from what I posted at the time for members inside The Leveraged Investing Club:

About These Returns and Why They Don't Really Matter

Yes, I know a 9.84% positive annualized spread isn't exactly a super lucrative return.

But keep in mind a number of very salient facts:

>> I'm on record as saying I felt I paid too much originally setting up the position

>> This first test trade was never about setting a land speed record

>> It was about making as many important discoveries as we could, discoveries that we could only make in the real world, not the lab

>> Now that we see the power of measuring the trade in terms of the annualized spread between our option selling gains and the extrinsic value expense, we can now focus much more effectively on increasing that spread

>> Keep in mind also that this trade is designed to never lose money at the end of the day (based on our confidence and assumptions about the effectiveness of our short option trade repair and management process)

Re: the returns themselves, there is actually a lot we can do to boost that spread - now that we've discovered this is what we should be focusing on - but that's going to be a conversation for another day.

Or said another way . . .

The significance of Kitty Hawk wasn't about finding the most effective mode of transportation on that particular day.

It was simply about Orville and Wilbur getting their contraption airborne and proving it could be done.

HOME : LEAPS Option Strategies : LEAPS Perpetual Income Strategy Examples - PYPL

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop