Divided Government, the Stock Market, and Long Term Investing

As a long term investor in the stock market, I long for divided government.

For non-U.S. readers, this discussion may be irrelevant. If so, I apologize.

When I speak of divided government, I'm referring specifically to the situation that occurs when one political party controls the Presidency and the other party maintains a significant majority in at least one chamber of the Legislative body, namely the Senate and/or the House of Representatives.

For the most part, I try to keep my political views off the Great Option Trading Strategies site because they have little to do with the site's purpose - helping myself and others to become successful long term investors.

But at the same time, the political landscape obviously impacts the macro-economic environment, and as a result, our personal investments. For what it's worth then, and in the interest of full disclosure, I would describe myself as a sort of fiscally conservative social libertarian.

What does that mean? It means that I'm perpetually under-represented and a deeply cynical moderate.

Let me be less abstract and more blunt: God, how I long for the good old days of divided government. I honestly don't care which party controls Congress and which is in the White House. I just wish neither party controlled both branches at the same time.

We've pretty much had that the first decade of the 21st century. Is it any wonder then that the term "lost decade" has become the unofficial description for that 10 year period?

A Lopsided Government

National politics is an ugly pastime at best, but when either party controls both branches of government at the same time, the outcome is certain - rampant arrogance, corruption, and hypocrisy.

There's little need to compromise or reach a consensus on any meaningful policy decisions when one party controls both the executive branch and the legislative branch.

When that happens, those policies tend toward the extreme rather than the moderate, and what you end up with are costly mistakes - whether you're talking about a stupid and needless war or a dramatic (and unfunded) expansion of the social contract and trillions in new debt.

The Uphill Battle of the American People

Americans are at their best when they choose divided government, when the politicians are forced to genuinely engage one another and actually work together to get anything accomplished. And, more importantly, when no single party can ram through their entire one-sided agenda.

In fairness to the American people, one of the biggest impediments to fair elections comes from the government itself.

Take the 2000 election, for instance. The Bush campaign essentially won the election in overtime. But elections aren't supposed to go into overtime.

And, objectively, I'm convinced that as close as the election was, and regardless of recount this and hanging chad that, a very slim majority of both Floridians as well as the country in general, chose to elect Al Gore. I'm not saying he would've been a great President, but with Republicans controlling the House and the Senate, how much damage could he have done?

But what I find truly sinister and repulsive is all the gerrymandering of congressional districts by state political parties. This isn't about creating true representation - it's about BOTH PARTIES exploiting demographics to prevent fair elections from ever occurring in the first place.

Checks and Balances and Long Term Investments

Why am I writing about all this on an investing website? In short, it comes down to this: divided government is good for both long term investors and the stock market. I've seen this personally in my own lifetime.

The great bull market of 1982-2000 occurred during a period where, for the most part, neither party controlled both the executive and legislative branches.

I say this in all seriousness, but thank God the Democrats had a robust majority in the House of Representatives during the Reagan years. And likewise, the 1994 Republican Revolution that ushered in Republican control of the House coincided with a period of consistent economic growth and even something that bordered on sound fiscal policy (at least in comparison to contemporary standards).

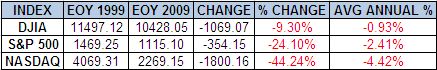

In contrast, consider the "lost" first decade of the 21st century. For the decade, the DOW was down a total of -9.30%, the S&P 500 was down -24.10%, and the NASDAQ was down a whopping -44.24%.

Checks and balances and gridlock produces a certain kind of rancorous stability, and stability, rancorous or otherwise, fosters an environment where growth, innovation, and the creation of value can flourish. It's a gift that the founding fathers gave to a fledgling nation more than 200 years ago, and it's one that's in our own best interest to embrace.

[Note: If this is a topic that resonates with you, then you should definitely check out the extremely well-written and politically sensible blog, Divided We Stand United We Fall.]

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop