Calendar Spreads vs. Diagonal Spreads

What's the Difference Between Calendar Spreads and Diagonal Spreads?

Calendar spreads, time spreads, horizontal spreads, diagonal spreads - yikes!

What's the difference among all these anyway, and how critical is it to be able to articulate the differences?

It's super important - if you've decided to publish your own option trading encyclopedia.

I've done a little of that formal definition thing on option spreads here if you're interested, but on this page I just want to give a general overview and then make the case for the big picture.

In my view, the terminology itself is not as important as having a basic structural understanding of what spreads are, understanding why they exist, and learning what they can do for you.

Calendar Spread Quickie

If we're going to be super precise, a calendar spread involves being long an option (call or put) that expires farther out in time and being short the same kind of option (call or put) with an earlier expiration. And both options share the same strike price.

A diagonal spread is similar to a calendar spread with the only difference being that the strikes are different.

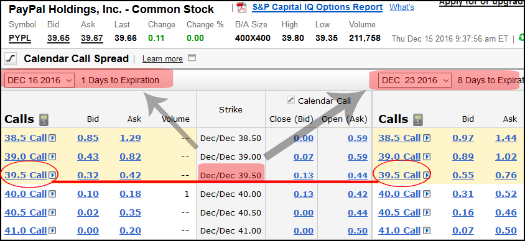

Here's a screenshot of what would officially be called a calendar spread (and you can click the image to enlarge it):

It's also known as a horizontal spread - which makes sense. Since we're talking about the same strike price, you can simply draw a straight line between the near dated option and the long dated option.

If you understand how a horizontal spread gets its name, then you can easily deduce why a diagonal spread is called what it is - placing two options side by side with different expiries AND different strikes results in a diagonal line drawn between them, not a horizontal one.

Limitations of Terminology

I generally refer to any spread with a longer dated long option and a nearer dated short option as a calendar spread - whether those long and short options strike price or not.

If I want to distinguish between spreads with the same strike and those with different strikes, then I'll refer to them as either horizontal spreads or diagonal spreads.

But really, I don't just sit around thinking about calendar spreads and worrying about whether the Options Industry Council approves of the use of my terminology.

Because at the end of the day, terminology doesn't matter, and the purpose of option trading isn't about using the correct jargon so we all appear sophisticated to outsiders - it's to control risk and leverage our returns.

If we're only hung up on encyclopedic definitions and conventional understanding of options, we're totally going to miss bigger picture and larger opportunity blend strategies and customize entirely new strategies and approaches.

When we need to give our strategies their own name because we've created strains and variations that haven't been defined by the CBOE, then we know we're on the right track.

Tweet

Follow @LeveragedInvest

HOME : LEAPS Option Strategies : Calendar Spreads vs. Diagonal Spreads

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop