Best Covered Call Strike Price

Understanding Strike Prices

When Writing Calls

Many option income traders want to know - what's the best covered call strike price?

The best way to answer that is to take a good look at the strike prices themselves.

Best Strike Price for Covered Calls:

General "Moneyness"

Moneyness is a weird-sounding word (and no, it's not how you flatter rich people, as in, "Yes, your Moneyness").

In option terminology, what the word means is the relationship between an option's strike price and the underlying stock's current share price.

Specifically, a covered call can be:

- In the Money - the strike price is lower than the current share price

- At the Money - the strike price is roughly the same as the current share price

- Out of the Money - the strike price is higher than the current share price

In general, there are important distinctions and implications related to the covered call strike price you choose.

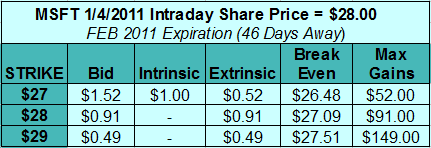

And for reference, let's look at this real world example of the three different type of strike prices available when setting up a covered call:

Is the Best Covered Call Strike Price Written In the Money?

Is the best covered call strike price written in the money?

An in the money strike price is the most conservative choice for writing covered calls because it gives you the most downside protection. In our example above, that's represented by the $27 strike price.

To calculate the breakeven point on a covered call, you take the current share price and subtract the total amount of premium received (you would also need to factor in commissions, but for simplicity I've excluded them in the table above).

So in our MSFT example, you wouldn't actually lose money on the trade unless the stock closed at the February expiration below $26.48/share.

The big drawback, of course, is that because the call is $1 in the money, only a portion of the premium received is comprised of extrinsic, or time, value. Your potential profits are limited since they only come from the extrinsic value portion of the premium.

In this case, two-thirds of the option's value is made up of intrinsic value (or think of it this way: the intrinsic value portion of the premium compensates you for the presumed $1/share loss of buying a $28 stock and offering to sell it for $27).

Important: The deeper in the money a covered call is (i.e. the lower the strike price is below the current share price), the more downside protection you'll receive . . . but the smaller your potential returns will be.

So in a nutshell, here's what you're looking at with this scenario:

- Your maximum gain (if the stock finished above $27/share) = $52

- Total percentage return = 1.86% in 46 days

- Annualized percentage return = 14.74%

- Downside protection (%) = 5.43% (you wouldn't lose money as long as MSFT wasn't 5.43% lower 46 days later)

Is the Best Covered Call Strike Price Written At the Money?

Is the best covered call strike price written at the money?

With an at the money strike price, you maximize the amount of extrinsic or time value you receive (it will always be highest when at the money), which in turn serves to provide some limited downside protection.

Since there's no intrinsic value involved, the entire amount of the premium received is potential profits - providing the stock closes at or above $28/share.

So why is the downside protection less for an at the money call than it is for an in the money call if you receive more time premium when you write it at the money?

Because you're starting at a higher strike price than you would with an in the money covered call, you'll receive less overall downside protection.

So the details on this set up would look like this:

- Your maximum gain (if the stock finished above $28/share) = $91

- Total percentage return = 3.25% in 46 days

- Annualized percentage return = 25.79%

- Downside protection (%) = 3.25% (you wouldn't lose money as long as MSFT wasn't 3.25% lower 46 days later)

Note: When there is no intrinsic value (at the money or out of the money covered calls), the downside protection equals the maximum option income gains.

Obviously, it's unlikely that you're always going to be able to write a covered call exactly at the money, but it's the general concept that's important here.

Most call writers would consider a strike price that's "close" to the current share price to be at the money.

Is the Best Covered Call Strike Price Written Out of the Money?

Writing an out of the money covered call produces both the smallest amount of total premium and downside potential, while at the same time allowing for the possibility of the most gains.

Why?

By selling the call at a higher strike price, the call writer retains rights to more of the stock's potential capital appreciation.

If the call is assigned to you and you wrote the option in the money, you're selling the stock for less than what you paid for it. And if you wrote it at the money, you're selling it at the same price you bought it. In either scenario, there simply can't be any capital gains.

The big drawback, of course, is that an out of the money covered call provides the least amount of downside protection.

The results would look like this:

- Your maximum gain (if the stock finished above $29/share) = $149

- Total percentage return = 5.32% in 46 days

- Annualized percentage return = 42.22%

- Downside protection (%) = 1.75% (you wouldn't lose money as long as MSFT wasn't 1.75% lower 46 days later)

So What Is the Best Covered Call Strike Price?

It really comes down to what your objectives are:

If you write covered call options primarily for the income, or if you're new to the trade, you really should consider writing them as deep in the money as you can while still generating a decent return.

Earning a low risk 10-15% annual return is, in my opinion, preferable to turning up the risk dial in order to target 25-30% annual returns.

- For longer term investors who would prefer to retain their shares, but want to sell calls to generate some additional income, writing those calls out of the money is the better way to go.

- And finally, for more experienced covered call traders who employ technical analysis as part of their strategy, then the best covered call strike price could be any of the three types based on current market conditions.

These concepts and scenarios are explored in greater detail on the Picking the Best Strike Price for Covered Calls page.

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop