Dividend Growth Investing:

Why It's Superior to Growth Investing

Note: I don't mean to be too provocative with my Dividend Growth Investing headline above. There is no single superior investing or trading strategy except that which you're best at and most drawn toward.

We're not all wired the same way, after all. As a result, we can't all recognize, appreciate, and capitalize on the same opportunities.

With that being said, allow me to present the following case in favor of Dividend Growth Investing that demonstrates - in my mind, at least - its superiority over regular Growth Investing.

The Allure of Growth Stocks

During the last great bull market from 1982-2000, dividend stock investing lost its allure as investors were spoiled by a market that pretty much went only one direction - up. Who cared about paltry yields of 2 or 3 or 4% when growth stocks provided much sexier returns year after year after year?

But the dirty little secret of all long term secular bull markets is that most of the returns are the result of an expanding Price-to-Earnings ratio, not simply due to increasing corporate earnings.

Yes, earnings increased throughout the 1982-2000 period, but in 1982 investors only had to pay $8 for each dollar of those earnings. By the end of the party, however, they were paying $30 for each dollar in earnings.

[That's the average for the whole market - at the height of the internet bubble, crazed market participants (somehow it doesn't seem right to call them "investors") had bid up the P/E on individual tech stocks to astronomical levels.]

The average annual real return during the 1982-2000 period was 14.8% (source: Micheal A. Alexander, Secular Market Trends).

Who wouldn't take that? An investment that compounds at an average of nearly 15% annually for 18 years is going to create some serious wealth.

The Incredible Shrinking Returns

The drawback to secular bull markets is that while they may last a long time, they don't last forever. They replace, and are replaced by, their opposites: secular bear markets.

Compare that 14.8% average return with what preceeded it during the 1966-1982 period: an average annual return of -1.5%. That's right - a 16 year period with a negative average annual return.

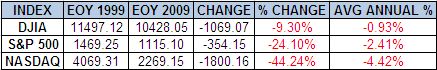

And what happened following the secular bull market of 1982-2000? Consider the table below that shows the 10 year returns on the three major market indices from the end of year (EOY) 1999 through the EOY 2009:

Only time will tell whether the next secular bull market began off the March 2009 lows, or whether it has yet to begin.

But what isn't in doubt is that the first decade of the 21st century has been abysmal for capital appreciation. Yes there were some good years in there, but the beginning and end of the decade both saw devastating bear markets.

The Performance of Dividend Growth Investing

Most market followers point out that the great 1982-2000 bull market technically began in August of 1982 (and ended in March of 2000).

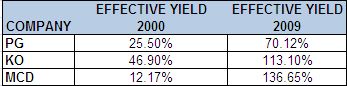

For simplicity's sake, let's imagine that you made investments in three long term superior businesses at the very end of 1981: Procter and Gamble (PG), Coca-Cola (KO), and McDonald's (MCD).

Let's further imagine that you held these stocks through the duration of the bull market. What would your effective yield, or yield on cost, be (the current annual dividends divided by your original investment)?

And, just as importantly, what would your effective yield be at the end of 2009, as a buy and hold investor who survived this bleak first decade of the 21st century?

The results on both counts, I find, are staggering:

These numbers aren't total return - this is the dividend yield (based on your original investment) that you would receive each year simply through the power of dividend growth investing.

Will every dividend paying company produce these kind of results? Of course not. Just as not every growth company turns out to be Microsoft in the 1990s.

Why Dividend Growth Investing in High Quality Companies Rocks

But the great advantage that dividend growth investing in superior companies has over traditional high growth investing is that your yield, and therefore your income, increases in bull markets and bear markets alike.

When you invest in superior, dividend paying companies, it's much more realistic to expect a positive dividend growth rate than a market cap (i.e. the current valuation of that company) that just keeps going up and up.

Dividend growth investing doesn't take a decade off (or longer) before making you money. The formula, in fact, is the essence of simplicity: high quality, dividend paying companies + time.

That's all there is to investing success and long term wealth.

[You literally need nothing else, but for the savvy, creative types who want to learn how to shave years off the process, there's always Leveraged Investing.]

Tweet

Follow @LeveragedInvest

HOME : Dividend Stock Investing : Dividend Growth Investing - Why It's Superior to Growth Investing

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop